Best for: Those with constant paychecks who want A fast Improve for their bank account. Pay out advance applications are built that will help you access your paycheck earlier than your envisioned deposit day. Due to the nature of this method, you’ll need to possess a steady source of revenue. Despite your credit rating, the greater predictable your paycheck is, the more most likely you are going to qualify for an progress. A paycheck advance isn’t a loan, and there is no interest charged.

Boost your credit score. When you don’t need dollars instantly, you might like to work on bettering your credit rating until eventually you can qualify for your financial loan with better conditions.

Applying for a brief-phrase loan ought to acquire all around 5 to ten minutes, presented you have all the data essential to finish the application shut at hand.

When you have terrible credit, a personal bank loan might cost you more mainly because lenders may even see you as a greater credit threat.

A lot of unsecured own loans might be quick for individuals with bad credit to acquire authorized for considering that they commonly Use a credit score requirement of 580 or bigger. Having said that, these loans are risky for lenders to supply since you do not have to put up collateral.

Supplies Get in touch with details. If a lender offers no more than a contact kind or an e-mail address, see how responsive it really is prior to deciding to use. A genuine payday lender shouldn’t shy clear of supplying a physical tackle, cell phone aid or Reside chat.

Transparency: We believe that particular financial loan terms needs to be effortless to uncover and decipher. Prequalification, which helps you to Examine what rate it's possible you'll qualify for with no difficult credit inquiry, is especially important. We also check to determine if a lender is recently penalized by regulators.

These loans are ideal for individuals who have to have speedy reduction from urgent costs but can repay the loan in a brief period of time.

HELOC A HELOC is a variable-charge line of credit that allows you to borrow funds to get a established period and repay them later.

Late Or Non-Payment Implications By accepting the terms and conditions for a private mortgage, you primarily comply with repay the loan both of those: 1) with desire and a pair of) in the timeframe laid out in the mortgage settlement. Usually, failure to repay the personal loan in entire, or making a late payment, may end up in additional prices.

Having said that, they provide quickly entry to income, and approval is typically depending on the value of your respective vehicle, not your credit record.

And be cautious: Sometimes, own loans marketing to individuals with lousy credit may have once-a-year share fees, or APRs, that are much increased than the typical particular loan, which means you’ll want to be selective and Evaluate many lenders Anytime feasible.

After you get yourself a credit builder mortgage, the lender usually places The cash you’ve borrowed into a reserve account it controls. You here then make typical payments toward the personal loan, building a good payment history that’s reported to your credit bureaus.

To secure a loan on the net with poor credit, you first need to have to match on the net lenders that settle for those with undesirable credit according to components like APRs, repayment intervals, personal loan quantities and fees. You then must submit an application for the most beneficial present and look ahead to a decision.

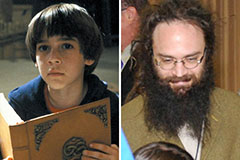

Edward Furlong Then & Now!

Edward Furlong Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Jason J. Richter Then & Now!

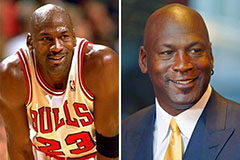

Jason J. Richter Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Shane West Then & Now!

Shane West Then & Now!